Google and Fire TV saw their respective shares of the smart TV and streaming media device OS global market tick upward in 2022 as the two took opportunities to pivot amid a slowing market, according to analysis from S&P Global. And the gains come as the U.S. looks poised for a smart TV refresh cycle, where others like Roku will work to maintain a streaming lead amid increased TVOS competition.

Data from S&P Global Market Intelligence found the combined global installed base for smart TVs and streaming media devices (SMDs) grew 7.5% year over year to 1.08 million units at the end of 2022, though the firm noted the streaming OS market has slowed markedly since the pandemic began. Although Samsung’s Tizen OS was still the market leader at the end of 2022 with Android TV’s base trailing, the gap between the two is narrowing, according to S&P.

S&P analyst Neil Barbour told Fierce that Android TV grew its market share of the combined global smart TV and SMD installed base by 2.1 percentage points year over year.

“Alphabet was able to achieve this growth in part by sacrificing its legacy Chromecast production line in late 2022,” Barbour noted. “Android TV is also supported by a wide array of smart TV partners, which accounted for half of all net additions.”

For Android S&P tabulated SMDs from Alphabet, NVIDA, Walmart and Xperi, as well as smart TVs from TCL, Sony Xiaomi and Element, among others.

Amazon, meanwhile, made its in-house brand of smart TVs a priority, with Barbour noting that helped its share of the smart TV and SMD market grow 0.4 percentage points year over year.

"Amazon’s growth was largely due to its new emphasis on in-house smart TVs, including the 4-series and Omni sets,” Barbour said. Although the market gains are global, both Amazon and Android TV are seeing similar market share gains in the U.S., he confirmed.

In late March Amazon disclosed sales of its Fire TV streaming devices and smart TVs had surpassed 200 million units to date.

Although in the smart TV and SMD sector Roku still leads the U.S. “by a very wide margin,” S&P found it’s losing share to Android TV and Vizio’s Smart Cast. While Roku debuted its own branded smart TVs earlier this year with availability at Best Buy, it’s a move Barbour doesn’t expect to have much short-term impact.

“Roku’s smart TV distribution network is relatively limited right now, so we might not see a big impact from the smart TV pivot in the near term,” he told Fierce. “We would expect better market share opportunities to emerge with more retail partnerships."

Still, “some of the excitement around new the Fire TV and Android TV products is likely to burn off in the year ahead, which would help Roku maintain its market share,” Barbour added.

U.S. poised for smart TV upgrade cycle

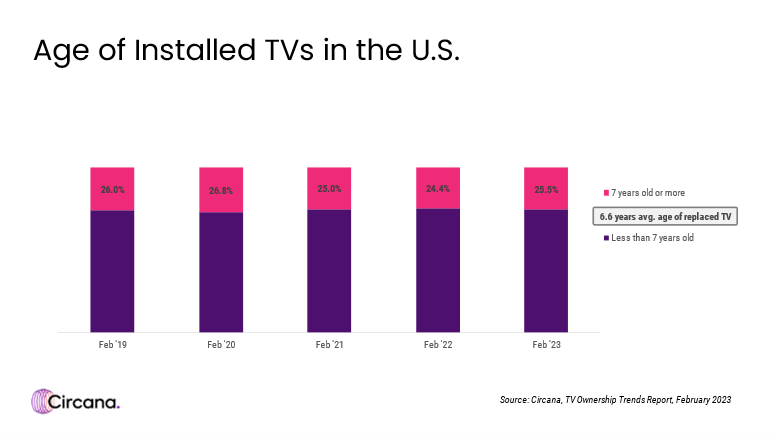

Google and Fire TV’s increases come at a time when separate research from Circana (formerly NPD) finds the U.S. is poised for a smart TV refresh cycle as TV sets continue to age.

According to Circana, most TVs are 6.6 years old when they’re replaced, and the average age of installed smart TVs in the U.S. is now 5.2 years. The firm also found that over a quarter (25.5%) of installed TVs are now seven years or older, the highest proportion reported since February 2020.

“The aging installed TV base is a positive indicator for TV manufacturers and retailers because consumers who purchased TVs earlier in the pandemic will soon be ready to replace them,” said John Buffone, vice president and industry advisor at Circana, in a statement.

Despite a decline in 2022, Circana’s Future of Technology forecast projects TV unit sales will see annual gains starting next year, returning to their pre-pandemic baseline by 2024 as the replacement cycle drives demand.

“Almost all U.S. households own at least one TV, and the average household owns more than two,” said Paul Gagnon, vice president and industry advisor at Circana, in a statement. “The demand cycle was disrupted by the pandemic, but we expect to return to the typical refresh rate by 2024. Once economic conditions improve, there is potential for two to three million additional TV unit sales based on one to two million new households in the U.S. each year and assuming the replacement frequency remains at 6.6 years.”

And as people look to upgrade their smart TVs, a Roku-branded set could help keep them in the company’s ecosystem while smart TV adoption continues to gain favor among consumers and streaming dongles plateau.

“We think the move to smart TVs helps Roku retain active accounts in the case of households upgrading from a dongle to a smart TV to stay within Roku’s operating system,” wrote Macquarie analyst Tim Nollen in a Monday research note to investors. “Or people that might own a TCL/Hisense branded TV that houses Roku’s OS might identify closely with the Roku brand and opt for a full branded TV. Given the degree of competition and the cross-over between OS providers and TV OEMs, Roku is at least making a defensive move.”

Nollen said that Roku’s CTV and advertising businesses are at critical junctures and believes the OEM needs to pursue both aggressively, noting it has a strong leading position in the U.S. despite competition from Amazon, Apple and Samsung but “a much a much lower penetration rate internationally, where we believe the long-term [TVOS] battle will be won or lost.”

OS wars impact advertising opportunities

As S&P highlighted, streaming OS players like Roku and Amazon have been putting more emphasis on their own branded smart TVs. Owning the operating system and hardware brings benefits to companies beyond straight device sales, providing data on viewing and consumption habits (such as with automatic content recognition) that can help enhance not only the user experience to drive engagement but also present opportunity for advertising revenue streams.

Nollen pointed out that Macquarie believes winning the TVOS war “is a crucial precursor to building [Roku’s] Platform revenue, which is high-margin advertising.”

“CTV advertising is moving through an inflection point as budgets shift and the means to deliver ads advance with more programmatic capabilities; we believe Roku is behind the curve here and must improve its processes to better monetize its large installed base,” the analyst commented. “We estimate that in doing so Roku could roughly double its ARPU over time.”

Speaking last year at a Go Addressable event, Evan Shapiro, NYU and Fordham professor, and CEO of ESHAP, called out Amazon and Google specifically on the connected TV OS front as poised to benefit as advertisers look for opportunities to shorten the distance between first impression and transaction in the CTV landscape.

“One of the key elements in the advertising business over the next couple of years is going to be the lack of distance between first impression and transaction,” Shapiro said. “And people who can enact that more efficiently with least waste are going to be the winners for brands. It’s not just the distributors it’s also the device makers themselves.”

At the event in November Shapiro pointed to Amazon’s increased focus on Fire smart TVs instead of dongles as well as the e-commerce giant’s close proximity between impression and transaction. He also said that Google, not only through Google TV but its Android operating system, is the fastest growing operating system on earth, noting it started paying OEMs small sums to implement its OS on smart TVs.

“Google is a major player, and Amazon is going to coincide with them, and they’re going to try and recreate a duopoly on the connected television advertising platform that Apple and Google now have on the smartphone,” Shapiro said at the Go Addressable event.