Fubo saw its customer base shrink to 1.51 million paid customers in North America during the first three months of the year, reflecting a loss of 100,000 accounts as customers churn out for other streaming options.

The sports-heavy streaming service offers comparatively less live events from top-tier franchises like the National Basketball Association (NBA) and the National Hockey League (NHL) during Q1 and Q2 due to its lack of carriage of Warner Bros Discovery (WBD) channels — namely, TBS, TNT and Tru TV — which offer some games from those sports organizations.

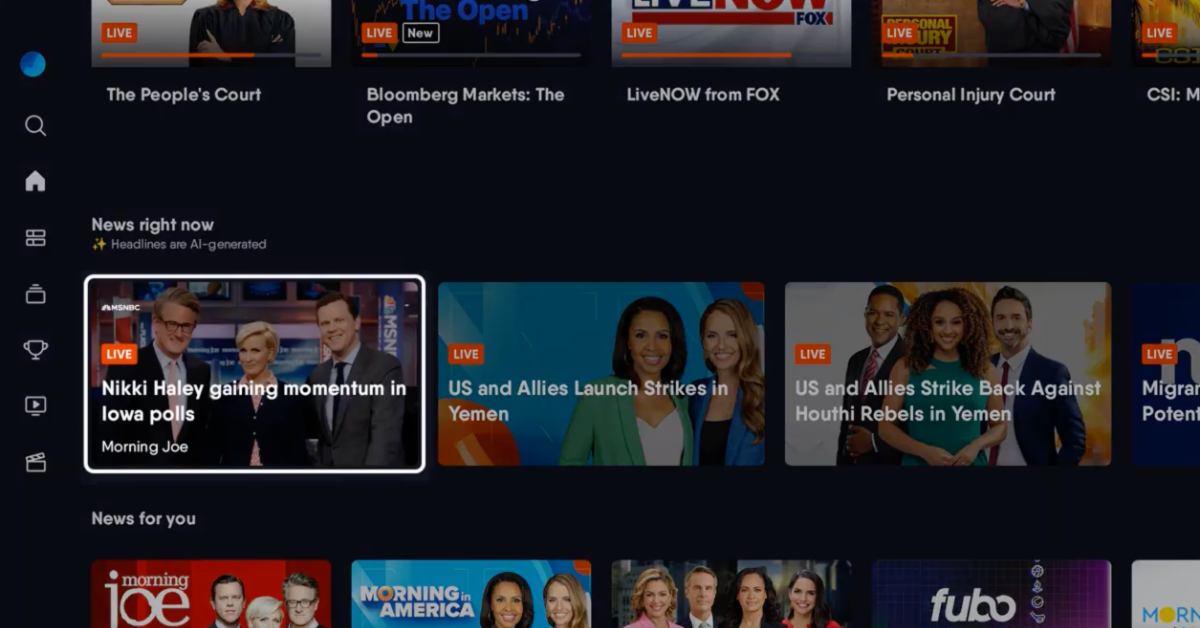

Instead, Fubo primarily markets the live sports programming carried on the four broadcast networks, ESPN, Fox Sports 1 and its regional sports channels. NFL games are a large driver of subscribers during the second half of the year, and higher churn during the first three months of a new year is not unusual for the service.

Shares of $FUBO down 11% on earnings day. https://t.co/IzQOHxrKr9

— Matthew Keys (@MatthewKeysLive) May 3, 2024

Meanwhile, a series of price adjustments helped grow Fubo’s North America revenue to $394 million, or 24 percent more on a year-over basis. Average revenue per user, or ARPU, climbed 10 percent to $84.54, an increase spurred by higher subscriber fees and more ad-supported streaming channels incorporated into the service over the past 12 months.

While Fubo is focused on growing out its service, the company is also battling two of its programming partners — Fox and ESPN — in federal court, alleging antitrust violations over the broadcasters’ plans to form a joint venture and develop a rival sports-inclusive streaming service by the second half of the year.

That forthcoming streamer, internally called “Raptor,” will offer access to local Fox and ABC stations along with national sports-inclusive networks like ESPN, Fox Sports 1, TBS, TNT and Tru TV. What sets Raptor apart from Fubo is that it won’t carry general entertainment and news networks like FX, Disney, Fox News and CNN. By comparison, programmers typically require pay TV services like Fubo to carry entertainment and news channels as a condition of offering subscribers access to live sports networks.

Fubo says the development plans for Raptor are unfair because broadcasters intend to offer their own joint venture more-favorable distribution terms than what they offer other cable, satellite and streaming cable-like services. The company has received support from two of its peers — DirecTV and Dish Network — along with Newsmax and former Locast operator Sports Fans Coalition, among others.

“We continue to believe in the merits of our antitrust lawsuit against the sports streaming [joint venture] partners and thank those who have publicly supported us,” David Gandler, the CEO of Fubo, said in a statement on Friday. “We are encouraged by reports of the Department of Justice’s investigation and look forward to our preliminary injunction hearing in August. Fubo believes if all distributors were offered fair terms, the consumer could have multiple and robust sports streaming options to choose from, access to just the channels they want, and at a price that’s right for them.”

Fubo has asked the federal judge overseeing their antitrust lawsuit to issue a preliminary injunction that would prevent the broadcasters from launching their streaming service in August or September. The judge has set a hearing date of August 7 to evaluate Fubo’s motion for an injunction.

“As we look ahead, the Fubo team remains focused on the core business as well as making progress against our strategic priorities,” Fubo Executive Chairman Edgar Bronfman, Jr., said in a statement. “We are balancing our profitability targets and growth while advancing in our technology capabilities, features and content.”

Bronfman said Fubo has “consistently met or exceeded guidance and expanded ARPU in a challenging macro environment, all while delivering a world-class viewing experience for consumers.”

Fubo says it hopes to grab between 1.675 million and 1.695 million subscribers throughout 2024 and is forecasting revenue in the range of $1.525 billion to $1.545 billion. If that comes true, it would represent a 4 percent year-over increase in subscribers and a 15 percent year-over increase in total revenue by the midpoint of the year.