Streaming apps Fox One and ESPN Unlimited are seeing a boost in adoption during the weekends thanks to premium college- and professional-level sports programming aired on both networks, according to new data from Antenna.

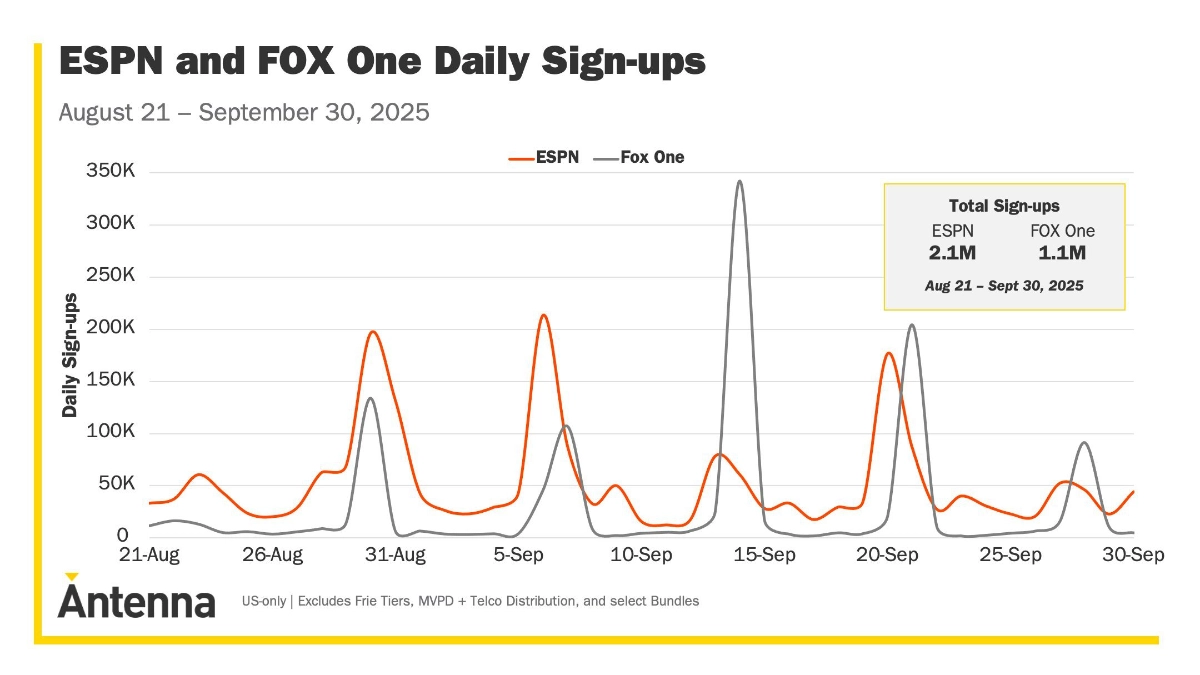

ESPN Unlimited saw more than 2 million new subscribers during its first 30 days on the market, while Fox One saw more than 1 million new subscribers, Antenna said.

The surge is largely credited to the start of the fall sports season, when both networks packed weekends with live events and marquee matchups. Fox One saw its biggest boost the weekend of September 14, coinciding with the Philadelphia Eagles-Kansas City Chiefs rematch, which drove nearly 350,000 sign-ups. The service is expected to see continued growth through national advertising during late-season NFL broadcasts and the upcoming World Series.

Antenna’s data shows Disney’s bundling strategy continues to be a key driver for ESPN’s streamer, with two-thirds of new subscribers opting into packages that include Disney Plus and Hulu. ESPN has also been far more active in national TV promotion: Antenna estimates 4,600 airings of ESPN streaming ads so far this year, generating 2.2 billion impressions and an estimated $13.8 million in media value. Roughly 3,500 of those airings appeared across Disney and ABC networks.

Fox One, by contrast, has yet to launch a major national advertising campaign. But Antenna previously said Amazon is a large driver of growth for the streaming service, with six out of 10 customers signing up for Fox One through Amazon’s Prime Video Channels marketplace. The trend largely tracks data previously released by Antenna that shows Amazon driving growth to other smaller streaming services like BET Plus, Britbox and MGM Plus.

Antenna uses opt-in data from financial records and other signals to estimate subscriber growth, retention and churn across streaming apps and plans. The data excludes the number of customers who have cable, satellite or streaming pay television subscriptions, some of whom receive included access to ESPN and Fox’s apps as part of their service, so actual adoption rates are likely higher than what Antenna reports.

Fox and ESPN launched their direct-to-consumer streaming apps and plans as a way to reach TV fans beyond the traditional cable bundle. The services debuted on the same day — August 21 — and both brands recently rolled out a bundle that pairs ESPN Unlimited and Fox One together for $40 per month. Separately, Fox One costs $20 per month and includes the full slate of Fox linear channels, while ESPN Unlimited costs $30 per month and includes the ESPN cable multiplex over streaming.

—

Read more: