By Brian Ring, Product Marketing & GTM Leadership, Ring Digital

This bidding war for Warner Bros Discovery (WBD) has served as a kind of Rorschach test on the future of leftover media assets — those legacy TV products that most folks generally refer to as “linear.”

In one corner is Netflix, which (arguably) has the strongest leadership team in the streaming industry. By that, I mean they excel in video on-demand streaming, but not necessarily linear TV like broadcast or cable.

In the other corner is Paramount, which wants the entirety of WBD’s business, including its legacy cable networks. For now, it appears Paramount has some hurdles, as Netflix appears to have won the initial battle for WBD.

At Netflix, it’s a bet-my-career decision for the leadership team in the post-Reed Hasting era. From what I’ve read, the decision to grab WBD was made very recently — it is exceptionally consequential, and it almost feels undisciplined.

Which is why I believe a huge portion of the rationale on this deal rests on streaming tech synergies which almost certainly can be achieved given Netflix’s world-class DIY infrastructure.

Will Netflix-WBD Get Approved?

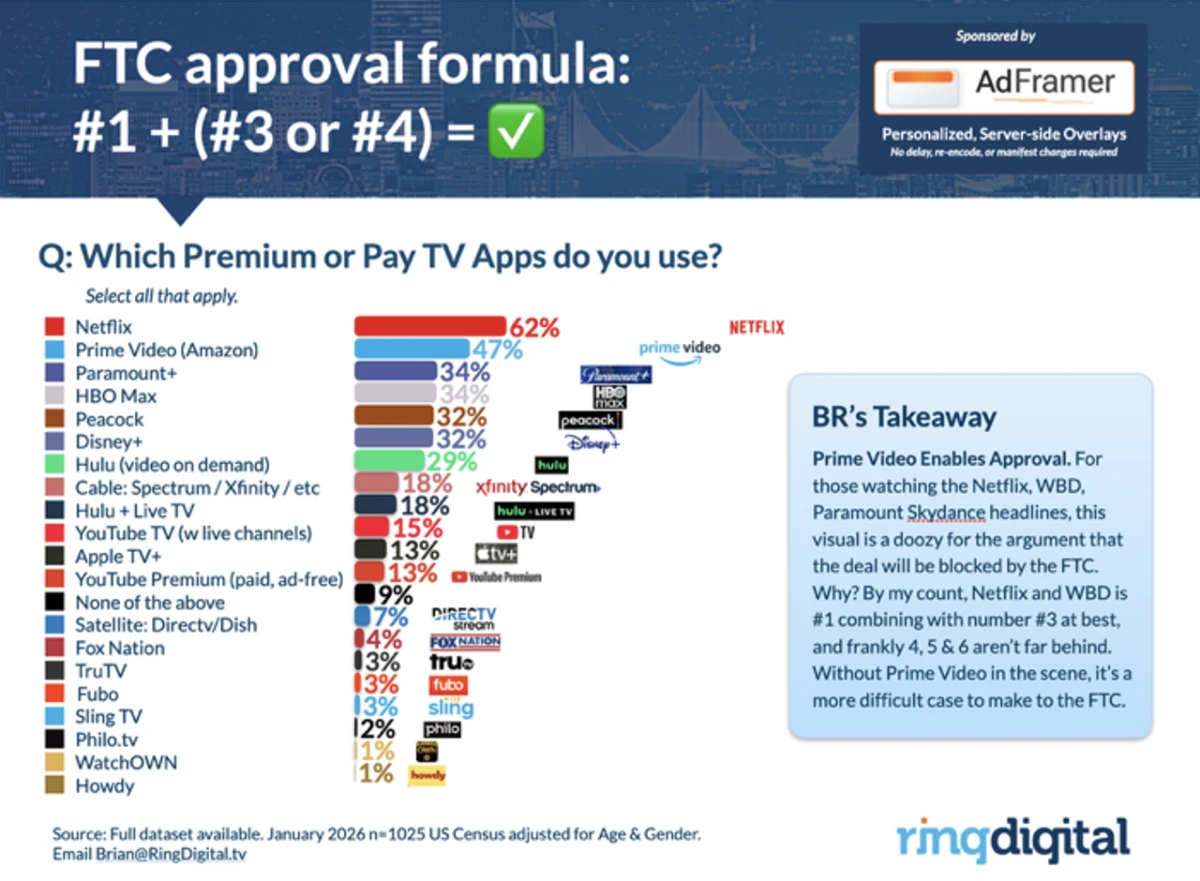

As you have no doubt read in press reports, Netflix‘s position as the clear market leader in premium streaming will result in stronger antitrust review of its proposed acquisition of WBD.

Market share and concentration of power are two elements that generally guide the decision-making processes of federal regulators like the U.S. Department of Justice, the Federal Trade Commission and the Federal Communications Commission (the latter agency won’t be involved in the Netflix-WBD review because neither company have assets that are FCC regulated.)

Historically, regulators have been critical of deals that might lead to higher prices for consumers. And a coupling of assets between two large players would be enough to break apart a deal through concessions, if not reject it entirely.

But WBD says its streaming service HBO Max isn’t the number one streaming app in the country. At best, it’s in a solid second place. Does that comport with reality?

Take a look at the latest data from our FutureOfTV.Live Winter 2026 report (you can get it for free by registering for our upcoming webinar). The data proves that Amazon’s Prime Video is actually in second place, based on our consumer survey, while HBO Max is near-even with Comcast’s Peacock, Disney Plus, Paramount Plus and Hulu for third.

Given HBO Max’s position among streaming services, it seems reasonable to think that the WBD deal — at least on that element — will get a green light.

HBO Max aside, Netflix’s interest in WBD rests with its film studio and intellectual property. As mentioned, Netflix doesn’t want anything to do with WBD’s cable networks business like CNN, TBS, TNT and Cartoon Network (though a revised offer does include the commercial-free basic cable network Turner Classic Movies).

You can’t blame Netflix for not wanting WBD’s linear TV networks. The bear case seems obvious when you examine some of WBD’s competitors: Versant, the business that comprises Comcast’s former cable networks, has struggled since its Wall Street debut earlier this month. As of Wednesday, its stock price is down more than 27 percent. Wall Street investors are speaking through their financial terminals: Without growth, the cable networks are worth nothing.

From Leftovers to New Linear

I disagree with that view. I see a huge bull case for driving new growth to the media sector through linear assets.

Viewed another way, Versant’s cable networks will earn nearly $3 billion in earnings before interest, tax, depreciation and amortization (EBITDA) on $7 billion in revenue, while WBD’s cable networks represent around $4.5 billion in EBITDA on $15 billion to $16 billion in revenue.

Assuming Netflix’s offer goes through, WBD’s cable networks business will be spun out into a separate company called Discovery Communications. That business is a prime candidate to couple with Versant — either through an acquisition by either player, or through a merger of its operations. A combined Versant-Discovery will earn $23 billion in revenue and produce $7 billion in EBITDA, and consists of premium brands like CNN, CNBC, TNT Sports, USA Network, Golf Network, SyFy, Eurosport and more. Across all those channels are premium sports rights, highly-viewed reality programming, entertainment and news.

That is already meaningful scale in traditional media terms. Each of those will certainly have a digital strategy as well. Add to that a renewed managerial focus which is a proven unlock for growth.

Some analysts are projecting an economic boom this year, driven primarily by the “Big Beautiful Bill” — and perhaps that could spark a positive uptick in TV advertising across all platforms and pipelines. Why wouldn’t this trickle down to traditional linear TV networks, especially if they combine forces?

If this seems implausible, look to the tech sector: Similar synergies helped Netflix justify its bid for WBD’s intellectual property, studios and HBO business. So, too, could synergized elements justify a combination of Versant and Discovery, if Netflix’s bid goes through and all parties are interested.

And there is enormous upside in pursuing that strategy.

Billions of the Smartest Training Tokens Annually

Between CNN, CNBC and the archives of Discovery, the amount of high-quality content that could be used as tokens to train large language models (LLMs) for artificial intelligence products is enormously valuable. Mix in video content, and whatever value is assigned grows by a multiple of 10.

Exactly how much is that written and video content worth to train an LLM? It’s still too early to tell, given the state of the current market — but, given the speed at which things are moving, it’s not too soon to consider.

—

The author’s opinions are his own, and do not necessarily reflect the views of The Desk or its parent company, Solano Media.

More Stories

- Netflix amends bid for Warner Bros Discovery, now an all-cash offer

- Netflix earns $45.2 billion in revenue during 2025, projects $51 billion in 2026

- Ampere: Netflix investment in premium sports paying off

- Paramount makes $78 billion hostile bid for Warner Bros Discovery

- WBD to split cable networks from streaming business (June 2025)