Key Points:

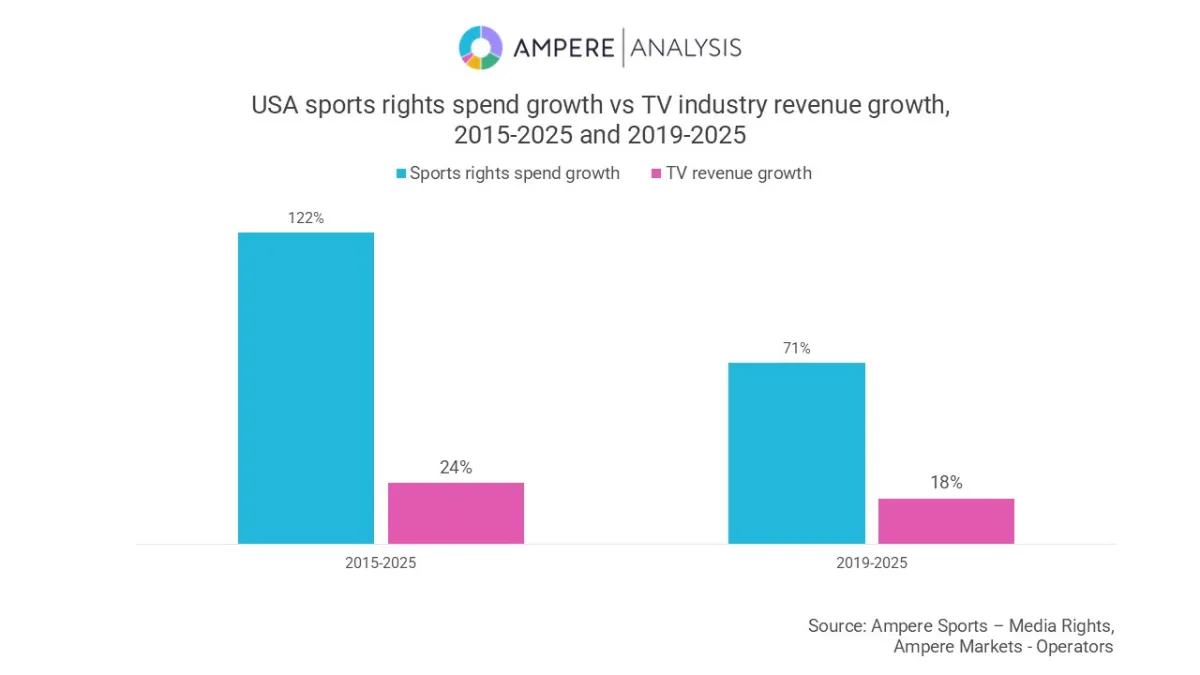

- U.S. sports rights spending jumped 122 percent to $30.5 billion in 2025, far outpacing TV revenue growth of 24 percent.

- NFL and NBA deals drove spending, with rights now making up 14 percent of total U.S. TV revenue.

- Europe’s spending is more subdued, and broadcasters are seeing a higher return on comparatively-lower sports rights payments.

Spending on sports rights in the United States has skyrocketed by 122 percent over the past decade, with television broadcasters and streaming platforms poised to spend $30.5 billion on live athletic events this, according to a new report from Ampere Analysis.

The sharp increase far outpaces overall television industry revenues, which grew just 24 percent during the same period, climbing from $172 billion in 2015 to $213 billion in 2025, Ampere said on Wednesday.

Sports rights now account for 14 percent of total TV revenue, compared to 8 percent a decade ago, emphasizing the premium value of live events as media companies battle for subscribers and advertising dollars in a fragmented market.

Ampere says the increase in sorts rights fees is rooted in landmark broadcast TV deals with leagues like the National Football League (NFL), the National Basketball Association (NBA) and Major League Baseball (MLB), which have spurred fragmentation across the TV landscape through diversified agreements with traditional TV broadcasters and emergent streaming platforms.

But TV distributors are willing to pay, because live athletic events are among the few types of programming that puts the most eyeballs in front of the TV screen — and other screens — at a single time, which generates higher interest from advertisers.

“The huge hikes in NFL and NBA deals demonstrate how live sports continue to deliver unique value as a driver of audience reach and retention,” said Daniel Harraghy, a research manager at Ampere Analysis. “As TV markets slow, sports rights inflation continues.”

The sports TV landscape in the U.S. is different from Europe, where growth in sports rights and associated revenues has been more subdued.

In the United Kingdom, spending has grown at twice the rate of TV revenues since 2015, and 1.6 times as fast in Spain. But in France and Germany, rights growth has largely stalled. Between 2019 and 2025, TV revenue growth outpaced sports rights spending across all of Europe’s “big five” markets, reversing the U.S. trend where rights spend rose at four times the pace of overall TV market growth.

“The more restrained approach in Europe reflects the tough economics of rights investment,” Harraghy said. “Market differences are being driven by several factors, including longer-term rights contracts in the U.S., business models that place greater emphasis on affiliate fees and advertising rather than subscriptions, and a more competitive rights market.”

—

Read more: