Specialty and niche streaming services are still growing their customer base, but there are signs that the pace of growth is starting to slow down, according to a new report issued by measurement firm Antenna.

In its latest “State of Subscriptions” report, Antenna said specialty subscription video on-demand (SVOD) platforms grew 12 percent year-over-year at mid-2025, compared to 22 percent growth in the same period last year. Premium SVOD platforms like Netflix, Disney Plus and Paramount Plus rose 10 percent year-over-year, largely in line with prior trends.

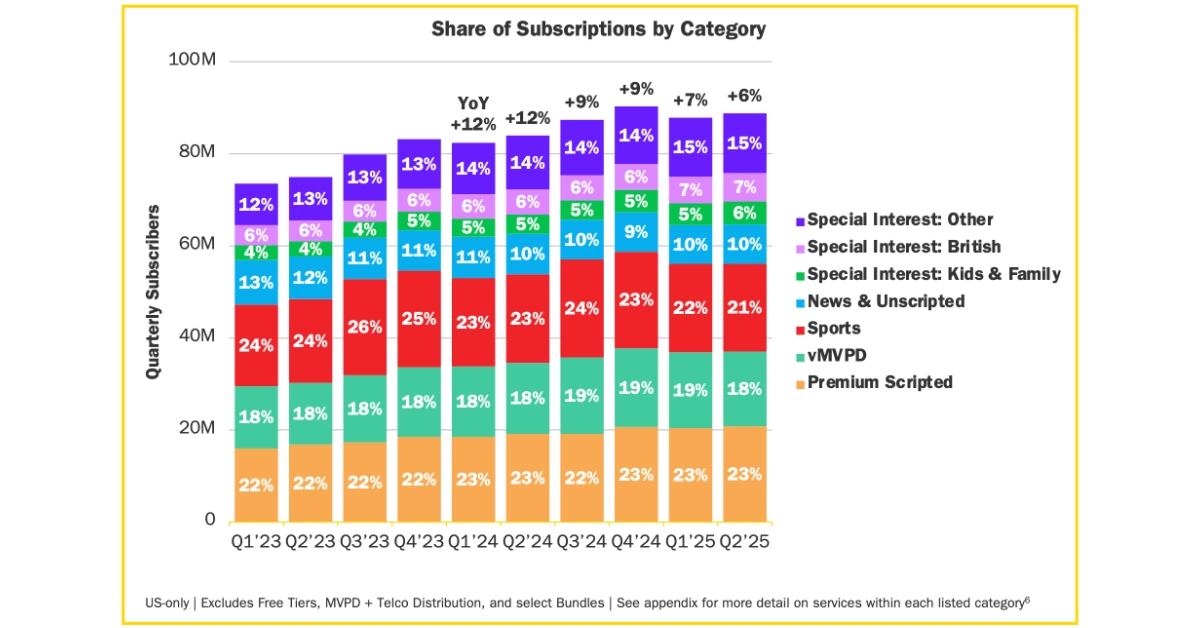

Overall, there were 339 million subscriptions across premium, specialty, sports and virtual multichannel video programming distributors (vMVPDs) by the end of the second quarter, an increase of 10 percent compared to 2024.

Specialty services like AMC Plus, Britbox and Crunchyroll have benefited from a broadening base of U.S. consumers seeking targeted programming. Antenna estimated 56 million unique users transacted with specialty services in Q2, up 68 percent from 2023, while the overall SVOD consumer base grew 20 percent to 177 million.

Antenna typically evaluates streaming service growth and churn using opt-in financial metrics from credit card bills, bank statements and other reports.

While streaming services are growing their platforms in terms of new customer additions, Antenna says there are signs that new subscriber acquisition is starting to slow. Around 3.2 million consumers signed up for a non-premium streamer for the first time in Q2 2025, down from 3.4 million during the same quarter a year earlier, Antenna’s report shows.

Churn rates have moderated across all categories. Specialty SVOD churn stood at 6.6 percent in June, down from 7 percent last year. Premium platforms continued to retain more subscribers, with churn averaging 4.1 percent, aided by Netflix’s long-term base. Sports streamers saw the most volatility, with churn fluctuating between 4.4 percent and 12 percent depending on the season.

Non-premium categories combined for 89 million subscriptions in Q2, growing 6 percent year-over-year. Within specialty, Antenna tracked growth in several subcategories, including British-interest services like Acorn TV and BritBox, which posted an 18 percent compound annual growth rate (CAGR) and reached 5.4 million subscribers. Premium scripted services such as AMC Plus, MGM Plus and Starz also climbed to 18.4 million subscribers, with a 13 percent CAGR.

Demographic data pointed to key differences in subscriber makeup. British-oriented platforms skewed older, with penetration among viewers 55 and older 18 points higher than the general population. Other specialty platforms leaned younger and more diverse, with Black and Hispanic viewers over-indexing by 19 points compared to the overall market.

Antenna said the data reflects both the resilience and the limitations of niche streaming, where consumer tastes remain diverse but growth patterns increasingly resemble those of larger platforms.

“Growth remains strong but is slowing,” the report said, adding that specialty SVOD now faces the same maturation curve that hit premium services beginning in 2023.